Future Safe by Allianz Retire+

Protecting your retirement savings

Future Safe is an investment product designed for Australian retirees. With Future Safe, you can keep growing your retirement savings by accessing the returns of the sharemarket and have peace of mind with the certainty of a range of outcomes. You can even limit your sharemarket losses to 0% (before the annual product fee and applicable taxes) if you want to.

Security + Growth + Income + Flexibility = Future Safe

We're here to help. If you have any questions or you would like to know more about Allianz Retire+ Future Safe, please reach us on 1300 371 136 (between 8.30am and 5.30pm AET, Mon-Fri).

Protection + Certainty

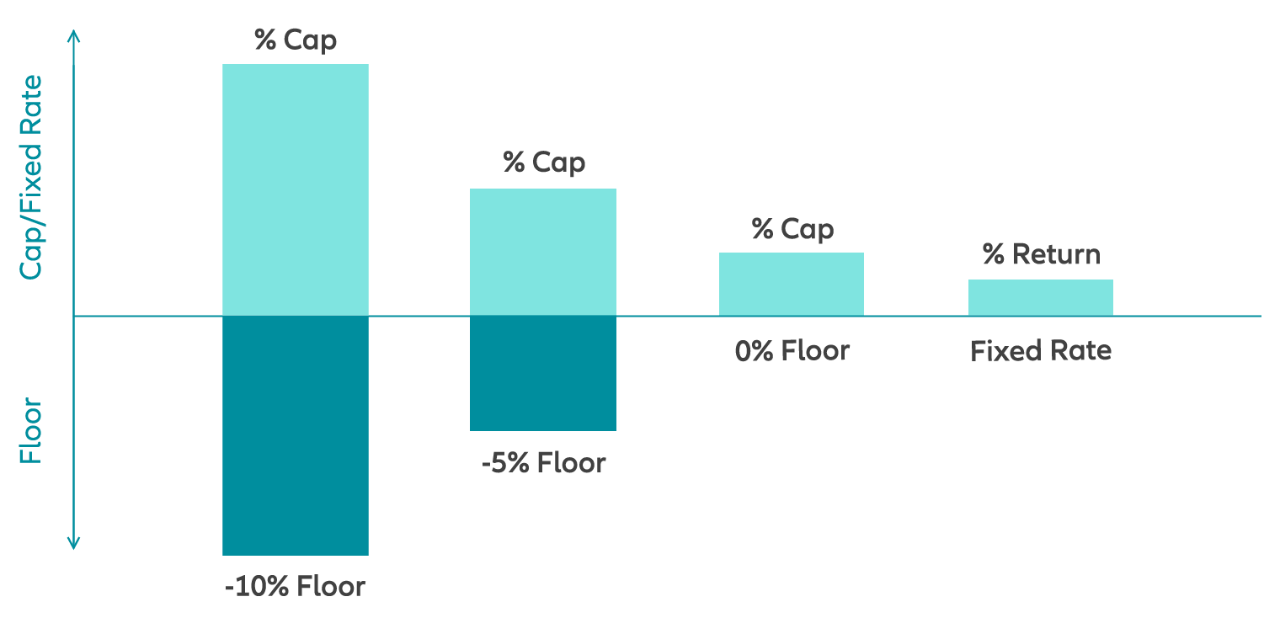

Future Safe can protect retirement savings when they're most vulnerable to a sharemarket downturn. We offer a range of protection options - expressed as Caps and Floors1 - allowing investors to benefit from market growth up to the selected Cap, while limiting losses to the selected Floor. Future Safe protection and investment options are reviewed annually, providing certainty in a range of outcomes for the year ahead and the flexibility to adapt to changing lifestyle needs or broader portfolio objectives.

1. The Caps and Floors, and return on the Fixed Rate are expressed before the annual product fee and any applicable taxes.

How Future Safe Works

2. S&P/ASX 200 Total Return Index; S&P/ASX 200 Price Return Index; MSCI World Net in Australian Dollar Index; or Fixed Rate.

3. Future Safe provides an amount that can be withdrawn free of charge each year. Amounts above the Free Withdrawal Amount will be subject to a Market Value Adjustment. When investing into a second (or subsequent) Investment Interval, the Free Withdrawal Amount will not include interest earned in the final year of the previous Investment Interval.

Who is Future Safe suitable for?

Ideal for pre-retirees or retirees

Future Safe is suitable for those who are near or in retirement and wish to protect their retirement savings while still benefiting from some growth.

It could also be suitable for those who wish to maintain their lifestyle, leave a legacy, invest tax effectively or access sharemarket returns with a lower level of volatility.

About Allianz Retire+

Creating the retirement Australians deserve

Allianz Retire+ brings together Allianz's insurance know-how with PIMCO's unrivalled investment expertise to create Allianz Retire+.

For 130 years, Allianz has been delivering financial stability and security to people around the world. Its proven track record is matched with PIMCO's gold-standard expertise and performance in income management. In 2017, we combined the skills of these two global leaders to create Allianz Retire+, an Australian company solely focused on creating the retirement Australians deserve.

Australians work hard. They deserve to be proud of what they’ve achieved and to feel confident about their financial security – their retirement should be a stress-free time. Allianz Retire+ is here to deliver the next generation of retirement investment solutions to the Australian market. Our solutions are designed to simplify the complex financial and emotional challenges that can confront people who are heading into retirement.

Want to know more? Please reach out to our team. Email us at enquiries@allianzretireplus.com.au

Case Studies

Get inspired by our examples of using Future Safe to enjoy retirement with confidence.