Summary

- RBA makes a hawkish cut while it highlights a wall of worry

- Domestic growth and productivity concerns remain constant in a volatile global environment

- Economic hard data is still yet to reflect any implications of global trade ructions

Summary

RBA cuts rate to 3.85% amid growth concerns...

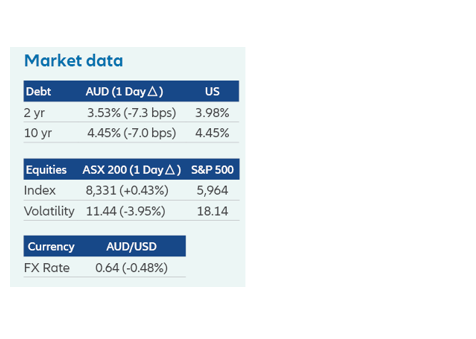

In a period of extreme volatility since the last RBA’s meeting, what has remained consistent has been market expectations for some kind of cut in May. This has shifted between calls for a 50bp cut leading a deep cutting cycle following the shock and awe of Liberation Day back to subdued expectations as market and geopolitical tensions have settled in time for the RBA’s May meeting.

With the March quarter trimmed mean inflation continuing its gradual descent coming back within the RBA’s 2-3% inflation target for the first time since 2021, the RBA had sufficient comfort in the data to support its existing forecasts and a 25bp cut.

Statement by the Monetary Policy Board

In the May statement, the RBA highlighted first and foremost that inflation continues to moderate, and maintaining low and stable inflation was reiterated as a priority. Higher interest rates have been working to bring aggregate demand and supply closer towards balance.

At the same time, many indicators suggest that labour market conditions remain tight. Employment is continuing to grow, measures of labour underutilisation are at relatively low rates and availability of labour is still a constraint for a range of employers. Wages growth has softened over the past year but productivity growth has not picked up.

The Board also noted that geopolitical uncertainties remain pronounced, and recent developments are expected to have an adverse effect on global economic activity, particularly if households and firms delay expenditure pending greater clarity on the outlook. This has also contributed to a weaker outlook for growth, employment and inflation in Australia.

Our Take

One doesn’t need a word cloud of previous statements by Governor Michele Bullock to understand her fervent desire to shape the RBA strategy and communication around its ‘data dependency’.

The potential second order impacts for the Australian economy from the emerging trade conflict remain uncertain on many fronts. On the supply side, textbooks suggest the highest levels of tariffs since the 1940’s imposed by USA will create a temporary step-up in inflation expectations. However in practice the recent COVID inflationary experience demonstrates the lingering nature of inflation, challenging any ‘transitory’ expectations for price levels.

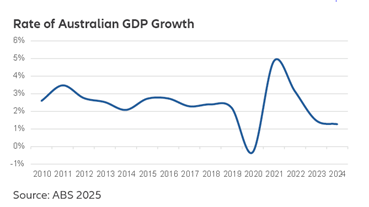

On the demand side, Australia remains considerably exposed to any (formal or informal) economic response by China. Growth concerns should remain paramount in an emerging multi-polar trading environment. However, a stimulus-driven demand boost as a function of China’s domestic deflationary environment, with resultant increased demand for Australian exports, appears increasingly likely in the short term.

But what if there is an absence of meaningful data for a central bank that reflects the recent global volatility? What remains is the long-running story of the Australian economy focused on growth and productivity challenges. In this light it’s appropriate to make monetary policy less restrictive when inflation and employment are well behaved with one’s forecasts.

Despite the implied certainty of a cut in this meeting by financial markets, the RBA will also have needed to consider the reasons not to cut the cash rate. Notably, employment is strong, property markets are heading up and services inflation continues to remain stubbornly high. The influence of global events on these local factors, particularly inflation, and the transmission into hard data points, will be instructive for the RBA when it convenes next in July.

Allianz Retire+ is a registered business name of Allianz Australia Life Insurance Limited ABN 27 076 033 782, AFSL 296559. This information contains opinions that are current as at May 2025 unless otherwise specified and is for general information purposes only and is not comprehensive or intended to give financial product advice. Any advice provided in this material does not take into account your objectives, financial situation or needs. No person should rely on the content of this material or act on the basis of anything stated in this material. Allianz Retire+ and its related entities, agents or employees do not accept any liability for any loss arising whether directly or indirectly from any use of this material.