Summary

- Cut, hold, repeat - RBA resumes cautious trajectory amidst global uncertainty

- Inflation concerns trump downside growth risk for RBA

- Timing, not direction, was the driver

Summary

RBA keeps powder dry and holds rate at 3.85%

The Reserve Bank of Australia (RBA) today defied widespread expectations of a second consecutive rate cut, although we expect the RBA to resume its easing cycle at its August meeting.

Timing matters, and with tariffs again being the topic du jour in markets this week, the Board has opted for a ‘wait and see’ approach, largely dismissing the latest monthly inflation reading, noting that inflation has ‘only been in target range for one quarter’ as they wait for the more comprehensive CPI numbers for Q2.

The Board continues to point to uncertainty in the global environment and a persistently strong labour market weighing on their confidence in the speed (but not the direction) of the inflation trajectory.

Statement by the Monetary Policy Board

In the July statement, the RBA highlighted that inflation has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance. However, uncertainty remains the key theme of the year, as both global and domestic unknowns weighed on their decision.

Locally, the impact of the latest cut combined with a tight labour market remains to be seen. Globally, risk remains elevated with no more certainty in international markets than at their last meeting.

Interestingly the Board pointed to the ‘rebound’ of financial markets as reflecting the ‘expectation that the most extreme outcomes are likely to be avoided’. The absence on clarity from the US is still weighing on households and firms, remaining a risk to the timing of any recovery in expenditure. Therefore, the Board was determined to remain measured in its approach as it ensures the sustainability of the inflation trajectory.

Our Take

Central bankers confront a volatile global environment where the ‘leader of the free world’ is actively telling people when to buy equities, extolling the virtues of cryptocurrency and pursuing a Nobel Peace Prize in real time. In this context, some mixed messaging is probably to be expected.

Inflation concerns and uncertainty were placed front and centre for the RBA in this meeting, as Governor Bullock noted ‘we don’t want to have to fight inflation again’. Throughout the year, the Board has shifted its focus and messaging as it alternates between inflation uncertainty and growth to justify its cut and hold cycle.

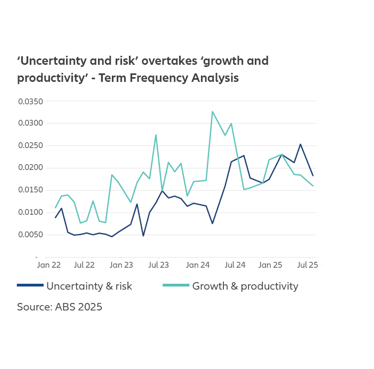

Clearly the trauma of Liberation Day in April lingers as the threat of tariffs return to the market. As our analysis of the text of previous RBA statements shows, uncertainty has infected the RBA’s thinking. In the absence of a cut, there was little mention of the risk for global growth, with the focus again on uncertainty and how this impacts inflation. Domestically, the latest national accounts showed an Australian economy that is barely growing and any mention of this was also omitted from the short statement released.

The RBA does not want anything to disrupt a ‘soft-ish landing’ of the Australian economy over a

multi-year horizon and has shown it is willing to surprise the markets with its decision if required.

Looking ahead, global risks will continue to weigh on the RBAs willingness to ‘pre-emptively’ cut too aggressively given the lags in monetary policy transmission. An August rate cut is likely, subject to confirmation in the upcoming quarterly CPI and the decision to hold this month might even provide the impetus for a 0.35% cut to 3.5% to appease those people who prefer round numbers!

Allianz Retire+ is a registered business name of Allianz Australia Life Insurance Limited ABN 27 076 033 782, AFSL 296559. This information contains opinions that are current as at May 2025 unless otherwise specified and is for general information purposes only and is not comprehensive or intended to give financial product advice. Any advice provided in this material does not take into account your objectives, financial situation or needs. No person should rely on the content of this material or act on the basis of anything stated in this material. Allianz Retire+ and its related entities, agents or employees do not accept any liability for any loss arising whether directly or indirectly from any use of this material.