Summary

- RBA raises rates for the first time since 2023

- Focus shifts to domestic inflation problem

- Bullock takes hawkish tone

Summary

RBA changes direction with return of inflation dragon

The Reserve Bank of Australia (RBA) increased the cash rate to 3.85% after conceding that inflation has exceeded their forecasts for the second consecutive quarter. Previously minimising the Q3 result as more ‘noise than signal’, the latest inflation result pointed to more persistent price pressures across housing and services. This decision was further fuelled by a drop in unemployment to 4.1%, well below the RBA’s estimated 4.5% for full employment.

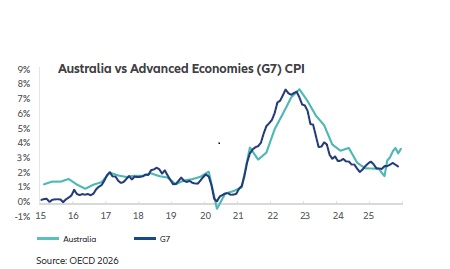

After Japan, Australia is the second advanced economy to begin a new rate rising cycle and is becoming an outlier with its inflationary environment (see graph). Accordingly, the RBA will be less able to blame global forces and energy shocks and must contend instead with how to balance domestically-driven inflation pressures in an economy that looks to be near, or at, capacity.

Statement by the Monetary Policy Board

In its statement, the RBA acknowledged that inflation has picked up materially in the second half of 2025 and, as a result, has revised its forecasts with the expectation that it will remain above target for some time. It was noted that the increase is reflecting capacity pressures which is a shift from the prior statements focusing on temporary factors and uncertainty around how much can be attributed to persistent trends.

Overall, the Board is taking a more proactive approach, given that private demand has strengthened more than expected and labour markets have stabilised at tight levels rather than showing signs of easing. Finally, the RBA noted high global uncertainty, but has only observed minimal impact on major trading partners or trade environment.

Our Take

With the recent data, the RBA have run out of excuses as ‘transitionary’ and ‘global’ sources of noise have given way to more ‘persistent’ and ‘domestic’ inflationary pressures. 2026 has begun with a clear and unambiguous signal to the RBA that Australia’s inflation challenge is homegrown and structurally driven - forcing them to take action after the ‘wait and see’ approach of late 2025.

Australia has suffered from a chronic productivity crisis since 2016 which leaves the economy and inflation outcomes extremely sensitive to capacity constraints. With tight supply in the labour market, inflation is the natural by-product of increased spending across both the private and public sector.

Government spending is close to a post-WWII high at 28% of Gross Domestic Product and shows no signs of easing. There has also been a growing momentum in private demand, fuelled by the continued strength of wages and a growing supply of credit that can be at least partially attributed to the previous three rate cuts in 2025.

Looking forward, the stakes have been raised for a policy error. If the private sector continues to gain momentum, the government will need to reconsider its fiscal policies if it wants to allow for growth. Alternatively, if merry public spending continues, the RBA may be forced to intervene further to restrict the growth of private demand as it balances the challenges of limited capacity and mediocre economic growth.

Martin Wilkinson

Head of Investments

martin.e.wilkinson@allianz.com.au

Adam Downy

Senior Investment Associate

adam.j.downy@allianz.com.au

Allianz Retire+ is a registered business name of Allianz Australia Life Insurance Limited ABN 27 076 033 782, AFSL 296559. This information contains opinions that are current as at February 2026 unless otherwise specified and is for general information purposes only and is not comprehensive or intended to give financial product advice. Any advice provided in this material does not take into account your objectives, financial situation or needs. No person should rely on the content of this material or act on the basis of anything stated in this material. Allianz Retire+ and its related entities, agents or employees do not accept any liability for any loss arising whether directly or indirectly from any use of this material.