RBA Joins Global Rate-Cutting Cycle!

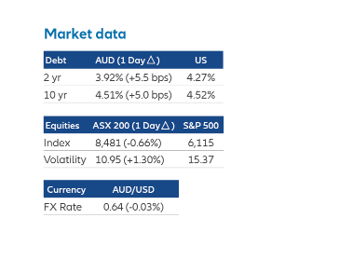

After 15 months of keeping rates on hold, the Reserve Bank has joined the global rate cutting cycle reducing the cash rate by 0.25 percent to 4.10 percent. RBA took comfort from recent progress in the battle against inflation and while noting geopolitical uncertainty emanating from the USA, it chose to make current policy settings less restrictive.

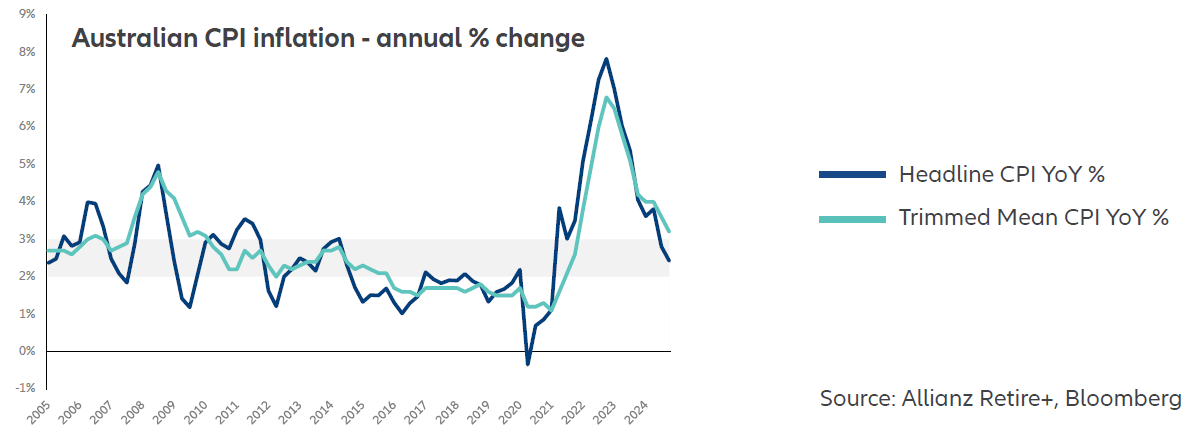

Inflation has moderated to 3.2 percent in underlying terms, within reach of the 2 percent to 3 percent target band. On a six-month annualised basis, the RBA’s preferred measure of underlying inflation is around 2.6 percent. Given this is ahead of RBA forecasts, this provided sufficient justification to change policy in the context of a strong jobs market.

RBA Statement

The RBA Monetary Policy Statement noted that both headline and underlying inflation have come down, partly because interest rates are slowing some areas of the economy. They cited that demand also seems to have eased in the housing market, which has seen a material slowing in housing and rental price increases.

Within the statement, it was recognised that the strength of the labour market was underpinned by strong employment growth in the non-market (govt) sector with the RBA recognising the risk to maintaining this strength if expected private demand does not materialise.

Globally, it was recognised that while new trade policies could lead to slower growth and potentially higher inflation, an escalation of current global trade tensions could also lead to an economic slowdown in Australia.