Summary

- Cautious RBA makes the cut it could have made in July

- It was a unanimous Board decision (9-0 vote)

- Market unsurprised given latest CPI and employment data

Summary

RBA cuts to 3.60% as inflation continues to moderate

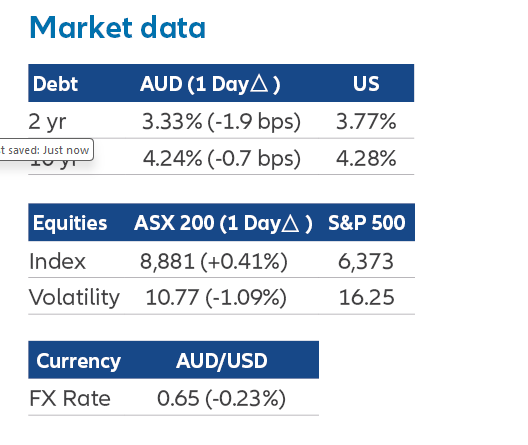

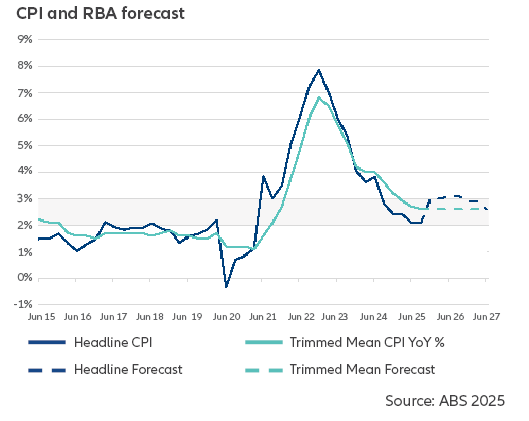

Following a surprise decision to hold in July, the RBA has opted to implement its widely anticipated 0.25% cut in a unanimous (9-0 vote) decision. Cutting this month is consistent with the Board’s cautious, gradual and data dependent approach; however, last month’s decision to hold rates may have been too cautious as the Q2 CPI came out largely in line with forecasts at 2.7% (trimmed mean).

While labour market tightness remains a concern, the recent increase in unemployment has provided an opportunity to question this abating risk. A contained inflation outlook and rising household stress suggests that any further delay in the cutting cycle risks constraining growth unnecessarily.

Statement by the Monetary Policy Board

There was little difference between August and July’s Statement of Monetary Policy. The Board highlighted that inflation has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and potential supply closer towards balance.

The Board continues to highlight the uncertainty of the global economy. While the Board has been reluctant in the past to provide their view, the expanded statement has included an indication that their forecast is showing this is expected to have a modest impact on growth and will likely be mildly disinflationary.

The forecasts released for the August meeting suggest that underlying inflation will continue to moderate to around the midpoint of the 2–3 per cent range, with the cash rate assumed to follow a gradual easing path. For the first time since the pandemic, the RBA has slashed the economy’s medium-term growth potential, by cutting its labour productivity growth assumption to 0.7 per cent, from a previous 1 per cent. This appears optimistic given there has been close to zero productivity growth since 2016.

Our Take

Market participants have come a long way from labelling central bankers’ terms like ‘Maestro’ (Greenspan) and expecting central bankers to espouse views on asset valuations or financial stability. The RBA reflects the ‘stay in their lane’ technocratic mindset of modern central banking. Once the data confirmed their forecast inflation trajectory, this decision was a fait accompli, with July’s surprise purely a question of timing rather than direction.

As the RBA becomes increasingly confident that domestic inflation is contained, the focus is shifting inwards to the downside risk on growth for the economy.

Governor Bullock has stated that Australia’s productivity slowdown is a challenge for government and business – not the central bank. However as the RBA becomes more focused on risks to growth it will be difficult to ignore the impact that productivity challenges are having on the Australian economy as this adds to global risks on growth and in turn the employment dimension of their mandate.

Despite their stated concerns about limited spare capacity, we believe there is at least one more easy cut this year, from there the terrain looks more difficult to navigate.

Allianz Retire+ is a registered business name of Allianz Australia Life Insurance Limited ABN 27 076 033 782, AFSL 296559. This information contains opinions that are current as at May 2025 unless otherwise specified and is for general information purposes only and is not comprehensive or intended to give financial product advice. Any advice provided in this material does not take into account your objectives, financial situation or needs. No person should rely on the content of this material or act on the basis of anything stated in this material. Allianz Retire+ and its related entities, agents or employees do not accept any liability for any loss arising whether directly or indirectly from any use of this material.