Our take

The tail risks in global markets have increased markedly in the intervening six weeks since the February board meeting. Trade policy uncertainty is heightened to say the least, with the latest barrage of tariffs expected from the Trump Administration tomorrow on ‘Liberation Day’. As a relatively open, trade-oriented economy, Australia remains particularly exposed to the direct and indirect risks of upending the world trade order.

Central banks should have front and centre the transmission potential of this uncertainty through elevated volatility in financial markets and the potential ‘wealth effect’ of negative asset returns on consumer sentiment. Bifurcated consumer spending patterns leave Australia particularly susceptible to these outcomes. Historically, the RBA has preferred to be late rather than early in reacting to shifting market conditions, and it’s hard to imagine this behaviour would change in current environment.

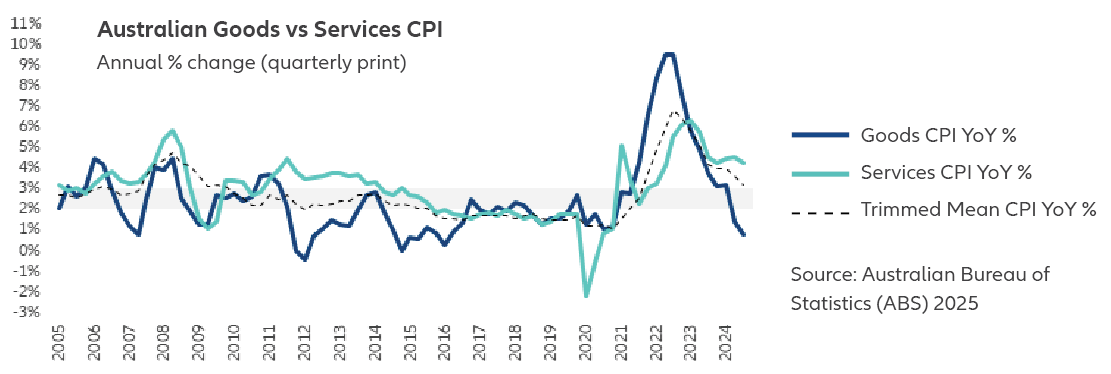

The divergence between goods and services inflation over the last 12 months remains a key risk for inflation expectations in Australia (see chart above). Problematically for the RBA, the global goods disinflation trend is starting to reverse.

Despite a return of market forces in 2025, we don’t expect a material shift in expectations around RBA’s next move. We believe it is reasonable for the market to continue to ascribe a 75-80% chance of a cut being delivered in May, with another cut on the horizon later this year.

Martin Wilkinson

Head of Investments

martin.e.wilkinson@allianz.com.au

Adam Downy

Investment Analyst

adam.j.downy@allianz.com.au

Allianz Retire+ is a registered business name of Allianz Australia Life Insurance Limited ABN 27 076 033 782, AFSL 296559. This information contains opinions that are current as at April 2025 unless otherwise specified and is for general information purposes only and is not comprehensive or intended to give financial product advice. Any advice provided in this material does not take into account your objectives, financial situation or needs. No person should rely on the content of this material or act on the basis of anything stated in this material. Allianz Retire+ and its related entities, agents or employees do not accept any liability for any loss arising whether directly or indirectly from any use of this material.