Sequencing risk refers to the order and timing of investment returns which, when you are drawing down on your savings, can impact how long your retirement savings can last. In other words, in retirement it’s not just how much you earn, but when you earn it.

Why does timing matter?

Retiring during a period of positive returns enable income drawdowns to be fully or partially offset by positive investment returns. On the flip side, if retirement coincides with a period of negative returns, falling asset prices and income drawdowns can magnify the scale of capital losses and erode savings at an accelerated rate – ultimately diminishing the total value of remaining assets.

· Losses early in retirement: if you experience significant market downturns early in retirement when you’re actively withdrawing funds, your portfolio can deplete much sooner. This leaves less capital remaining to recover when the market eventually rebounds.

· The impact of withdrawals: during retirement, you’re likely to fund your lifestyle by making withdrawals from your retirement savings. Negative returns early on can hinder your portfolio’s ability to sustain your desired lifestyle.

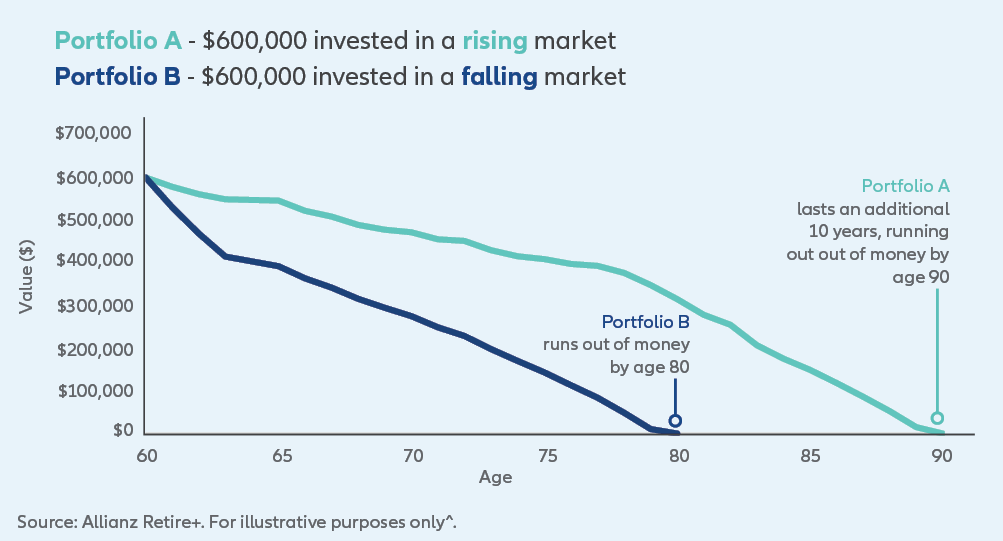

An illustration: the impact of sequencing risk on portfolios in retirement

Let’s look at two identical investment portfolios of $600,000 - Portfolio A and Portfolio B. Performance of the two portfolios is identical and each portfolio withdraws $40,000 every year.

Now, here’s where things get interesting: although the performance for Portfolio A and Portfolio B is equal over 30 years, the timing of their returns makes a big difference.

Portfolio A starts off strong with a rising market, gaining 3%, 4% and 5% in the first three years.

On the other hand, Portfolio B faces a rough start, with the market dropping by -5%, -4% and -3% in the first three years.

Even though they both experience the same overall performance over 30 years, Portfolio B runs out of money by age 80, while Portfolio A lasts until age 90.