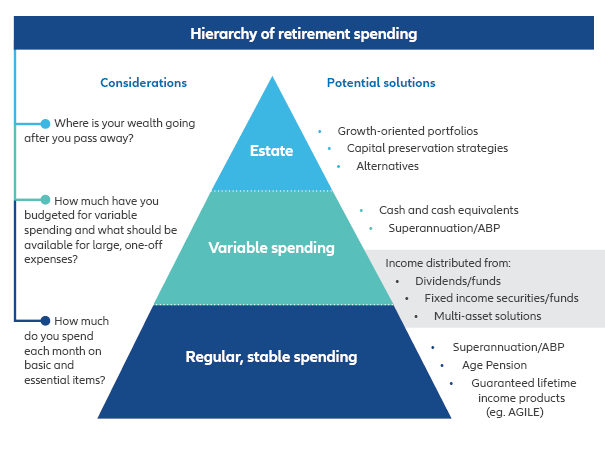

Dependable income sources, like Allianz Guaranteed Income for Life (AGILE), are particularly suited to covering essential expenses. AGILE provides a stable income stream that remains unaffected by market fluctuations, offering retirees the security they need to manage regular expenses.

For more variable costs, advisers can recommend growth-oriented solutions and maintain a cash reserve to provide flexibility and security.

Structuring a portfolio to align with income needs

Diversification is a cornerstone of effective retirement portfolio structuring. The Association of Superannuation Funds of Australia (ASFA) highlights a significant gap between median superannuation balances and the savings required for a comfortable retirement. This gap emphasises the need for retirees to diversify their income sources beyond traditional savings, incorporating dividends, interest, rent, and other income-generating assets.

Growth-oriented portfolios offer the potential for increased returns but come with inherent risks. For clients seeking stability, guaranteed lifetime income products like AGILE present a compelling solution. AGILE offers downside protection, ensuring that lifetime income payments do not decrease even when markets fluctuate. This stability is invaluable for retirees who prioritise predictable income over variable income.

Options when income falls short

Retirees facing projected income shortfalls have several strategies at their disposal:

- Taking on Greater Risk: Shifting to growth-oriented investments can potentially increase returns, but this approach requires careful consideration of risk tolerance and market conditions. Advisers must manage portfolios diligently to mitigate sequencing risk.

- Delaying Retirement: Postponing retirement can allow for additional savings accumulation and potentially higher or longer retirement income. However, this option may not be attractive or feasible for many retirees.

- Cutting Back Spending: Adjusting lifestyle expectations and reducing discretionary spending can help manage limited resources. Tailored advice is crucial in helping clients make informed decisions about spending adjustments.

- Incorporating Guaranteed Lifetime Income Streams: These offer a dependable income source that can bridge the gap between funding essential expenses and available funds. AGILE’s design incorporates a guaranteed future lifetime income rate and investment options with downside protection, managing longevity and sequencing risk to ensure financial security throughout retirement.

The role of guaranteed lifetime income streams

Lifetime income streams function as a form of insurance against the financial risks of outliving savings. By allocating a portion of a client's portfolio to AGILE, advisers can provide clients with peace of mind, knowing their budgeted essential expenses will be covered regardless of market conditions. AGILE's flexibility allows for partial or full withdrawals if there is an unplanned expense or a change in circumstances, offering adaptability in retirement planning.

When determining the allocation for lifetime income streams, advisers should start with the client's monthly retirement budget, assessing how much income is needed for daily living expenses and identifying portions of spending that may fluctuate. This tailored approach ensures that clients can maintain their desired lifestyle without financial stress.

As the landscape of retirement planning evolves, so too must retirement income strategies. By diversifying income sources and incorporating guaranteed lifetime income products, financial advisers can help clients achieve a secure and comfortable retirement. Not all income is created equal; structuring a retirement portfolio requires an understanding of spending hierarchies and income sources. With the right strategies in place, advisers can empower their clients to navigate the complexities of retirement with confidence and clarity.