While we try to make it simple to access information about Allianz Retire+ there are always extra questions that are asked. Here are some frequently asked questions.

Future Safe application

| TYPE OF APPLICATION |

|

| Individual |

|

| Joint |

|

| Company |

|

| SMSF |

|

| Unregulated Trust |

|

Please note that we may treat the application as valid whether the application form is signed manually, electronically or is not signed where it has been submitted to us by you, your adviser or other person on your behalf.

1If you authorise us to verify your identity information with the official record holder of the identity information or via a third party electronic verification service provider, you may not need to provide us with certified copies of your identity verification documents.

If Application has not been submitted:

- Retrieve your application in the apply section by clicking here

- Enter in application ID, last name and email address

If Application has been submitted:

- Call us on 1300 371 136 (general enquiries) or 1300 421 060 (adviser enquiries) and quote your application ID, last name and email address

- Email us at administration@allianzretireplus.com.au and quote your application ID, last name and email address

One or more of the following could be outstanding:

- Completed and signed application form

- Certified identity verification (photo ID)

- Your initial investment

- Signed direct debit authority or super rollover form

- Or other information set out under "What is required to apply?"

If your valid application is received in our Sydney office before 3pm (AET) on a Sydney business day (cut off time), your application will generally be processed on that day. If your application and money are received after the cut off time, or on a non-business day, your application will generally be processed on the next business day.

Please ensure that each page of the relevant document(s) is certified. The person certifying must state their capacity (from the list below) and state on each page that the document is a true and correct copy of the original:

- Justice of the Peace

- Agent of the Australian Postal Corporation who is in charge of an office supplying postal services to the public

- Officer with two or more continuous years of service with one or more financial institutions, for the purposes of the Statutory Declaration Regulations 1993

- Finance company officer with two or more continuous years of service with one or more financial companies, for the purposes of the Statutory Declaration Regulations 1993

- Officer with, or authorised representative of, a holder of an Australian financial services licence or Australian credit licence, having two or more continuous years of service with one or more licensees

- Judge of Court or Magistrate

- Person who is enrolled on the roll of the Supreme Court of a State or Territory, or the High Court of Australia, as a legal practitioner i.e. an Australian lawyer

- Chief executive officer of a Commonwealth court

- Registrar or deputy registrar of a court

- Australian consular officer or an Australian diplomatic officer

- Member of the Institute of Chartered Accountants in Australia, CPA Australia or the National Institute of Accountants with two or more years of continuous membership, i.e. an accountant

- Police officer or notary public

Making changes

You can request to change your contact details by completing a Change of Details Form (click here), and emailing it to administration@allianzretireplus.com.au. Alternatively, you can call us on 1300 371 136 (general enquiries) or 1300 421 060 (adviser enquiries).

- You have the option to reset your protection and investment options annually, at the anniversary date of your policy.

- If you would like to change your protection and/or investment options you can notify us of your changes by calling us on 1300 371 136 (general enquiries) or 1300 421 060 (adviser enquiries) or completing the Anniversary Election Form and sending it to us.

Withdrawals

- Yes, you are able to access your funds through regular or ad hoc withdrawals to suit your needs, subject to certain conditions that apply to the withdrawal of super money.

- If you have rolled over super money, you are required to withdraw a minimum income stream.

- If you have not rolled over super money, you do not need to make any withdrawals from your account, but can choose to.

You can request a one off withdrawal by:

- Calling us on 1300 371 136 (general enquiries) or 1300 421 060 (adviser enquiries)

- Completing a Withdrawals and Payment Form (click here)

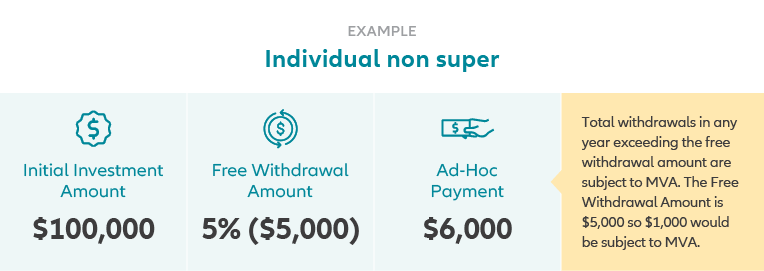

Amounts above the "Free Withdrawal Amount" will incur a Market Value Adjustment (MVA) charge.

- Future Safe provides an income stream which may be up to the Free Withdrawal Amount. If the investment money is Super Money, then under Superannuation Laws we are required to pay you, the client, a minimum amount of income. That amount will form part of the Free Withdrawal Amount and may be subject to withholding taxes.

- The minimum annual payment requirements are based on a percentage of the initial investment amount or Asset Value at July 1 each year. The percentage is age based as per the super laws and is set out below:

Age Minimum Annual

Regular PaymentsTemporary Minimums (2020/21) Under 65 years 4% 2% 65 - 74 years 5% 2.5% 75 - 79 years 6% 3% 80 - 84 years 7% 3.5% 85 - 89 years 9% 4.5%

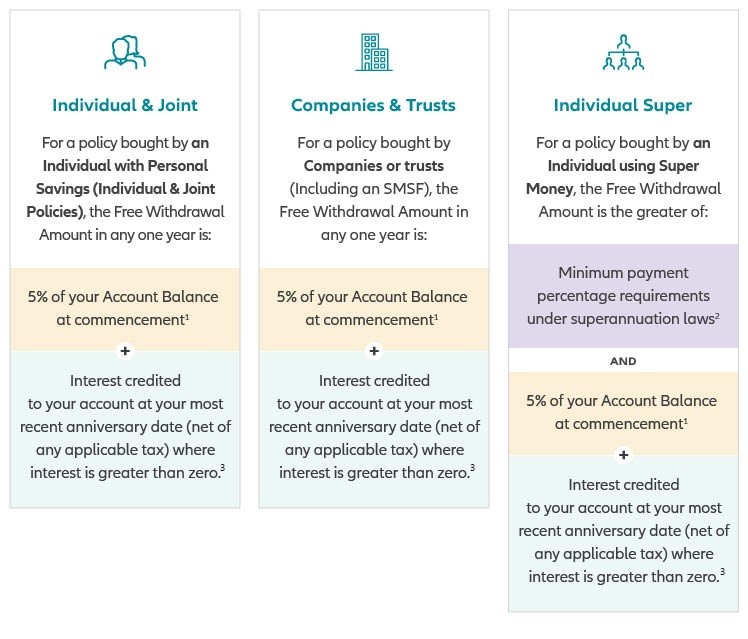

- Future Safe includes a Free Withdrawal Amount which sets the amount that can be withdrawn free of charge. This amount is 5% of initial investment plus interest from the prior year.3

- Amounts above the Free Withdrawal Amount will incur a Market Value Adjustment (MVA).

- Each time a withdrawal is made (whether a regular payment, ad hoc payment or ongoing adviser service fee), the Free Withdrawal Amount available for the year will be reduced by the amount of the payment.

- The Free Withdrawal Amount resets on each Anniversary Date. Any unused portion does not carry forward.

1. Account Balance at commencement is your initial investment less any applicable taxes, stamp duty and upfront adviser service fee.

2. Calculated on the commencement date and each anniversary date as an estimate of your minimum annual payment amount to the next anniversary date (see page 36 on the PDS). If your minimum payment amount changes before your next anniversary date, your Free Withdrawal Amount may change when your minimum payment amount changes.

3. When investing into a second (or subsequent) Investment Interval, the FWA will not include interest earned in the final year of the previous Investment Interval

Getting account information

You can receive your current balance by:

- Calling us on 1300 371 136 (general enquiries) or 1300 421 060 (adviser enquiries) or

- Emailing administration@allianzretireplus.com.au

On an Annual basis, in mid-July each year, a Payment Summary will be sent to you indicating any financial withdrawals and tax withholdings. This can be sent via email or post depending on your preference.

Your Adviser and Fees

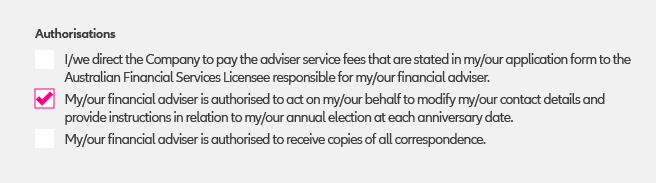

Yes. Your adviser can act on your behalf to change your details or Annual Election at each Anniversary Date, only if you have selected the authorisation box on your original Application Form

- The Customer may agree with their Financial Adviser, to pay them for their services they have provided. This is known as an Adviser Service Fee (ASF)

- The ASF is optional and is negotiated between the Customer and their Financial Adviser.

- There are 2 types of ASFs:

- Upfront ASF - This is a one-off amount that can be paid as a flat dollar figure or percentage of the initial investment

- Ongoing ASF - This is an ongoing fee that can be paid as a flat dollar figure or percentage of your Account Balance at the commencement or most recent anniversary date (whichever is later)

- Upfront ASF - This is a one-off amount that can be paid as a flat dollar figure or percentage of the initial investment

On the 1st and the 15th of each month, all upfront and ongoing ASFs are paid to the Australian financial services licensee that has authorised your financial adviser to provide the financial advice to you in accordance with the arrangements you have with that licensee.

Investment Intervals

Approximately 45 days prior to the end of any Investment Interval, we will notify you of your options and ask you to make a selection.

You will generally have these main options:

| Remain Invested and select an additional Investment Interval from the options available at that time. |

If you choose to invest in a new Investment Interval and we receive your instructions before the end of your existing Investment Interval, your new Investment Interval will commence on the first day after the end of your existing Investment Interval. You must meet the eligibility criteria at that time including those for age and investment amount. |

Withdraw all or part of your investment and be paid out as a lump sum. |

If you decide to be paid out as a lump sum we will process your payment on the first Sydney business day after the completion of the Investment Interval. |

Complaints

Your feedback is important to us. We’d like to resolve any complaint you have as quickly as possible. If you have a complaint, please call us on 1300 371 136 between 8.30am and 5.30pm (AET), Monday to Friday or email us at administration@allianzretireplus.com.au.

For details of our complaints process click here.

If you require assistance with accessing information about our complaints process or would like to discuss your complaint in a language other than English, just ask our Call Centre staff for assistance and they will arrange this for you where possible. You can call us on 1300 371 136 or email us at administration@allianzretireplus.com.au.